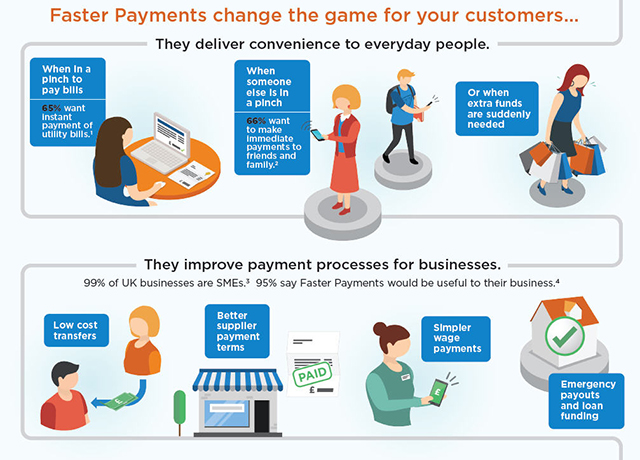

First and foremost, one has to admit that fast payments are impressive and extremely convenient, but that’s not all they are. When it comes to business, fast payments are also imperative for various reasons that have made them a necessity rather than a convenience in this age and time. Let’s now take a look at the specific situations where they are most utilised and why they hold so much importance in business transactions.

The Four Types of Transactions

According to the annual financial reports, there are primarily four types of transactions which benefit the most from same day payments and they are as follows.

- Person-to-business transaction (C2B): emergency/last minute bill payments

- Business-to-person transaction (B2C): Paychecks, insurance payouts, etc.

- Business-to-business transaction (B2B): Payments made to manufacturers and suppliers

- Person-to-person transaction (P2P): Small business transactions and personal payments

As billions of transactions fall within these four categories each year in the UK, it isn’t hard to understand why fast payments are so important.

On the Clock Payments

While salaried workers also benefit from faster payments, when it comes to freelancers and other workers who work on an hourly basis, it is more than just a convenience. It’s easier for employees if they can get paid instantly after clocking out, instead of having to wait for the week to end. From the point of view of the employer, it’s more efficient and the payments made to their employees are directly proportional to the hours they put into their respective jobs. In fact, in a survey conducted by the National Automated Clearing House Association (NACHA) on 1,500 payroll professionals, it was found that over 90% of them would prefer it if they could use same day payment solutions to pay their employees on time.

The Situation with the Banks

As things stand now, banks do not have too much to gain financially from faster transactions, but it would be a mistake to think that fast payments do not matter to banks because they will in the long run. People are getting more and more used to fast, on-demand services and banks are no exceptions to such expectations either. Financial institutions that make the necessary changes required to incorporate same day payments are more likely to hold onto their customers, while the ones which don’t will begin to lose customers to their competition in due time. Banks themselves are slowly acknowledging this fact because HSBC became the second bank (Barclays was the first) in the UK last year to offer fast payment options to its business accounts.

Continuous Service

Although speed is usually the highlight when it comes to instant payments, there is another aspect which defines a good fast pay service, and that is reliability. It is important to choose a service for same day payments, which can give you the flexibility and the reliability of being online 24/7, facilitating fast transactions irrespective of the time. An example of this can be seen through the AccessPay same day payments system which is available 24/7, with the majority of funds being cleared in less than 15 minutes.

Online businesses and large-scale corporations need continuous service because their financial dealings don’t have fixed hours and nor do they conform to traditional Holidays.

Fast Payments are a Step towards Financial Evolution

We live in an age where the internet has expanded the scope of business to massive proportions. Almost everything has become more convenient and infinitely faster, which in turn has propelled businesses to previously unthinkable heights. Same day payments and other fast payment options are a part of that digital evolution in the financial sector and they are the future of both business and personal transactions. They are an important step, which all modern businesses must take or risk being outdated and thus neglected in the near future.

It can be said that faster payments are instrumental for making decisions and plans. Whether you are a worker or a business owner, the quicker you receive your money, the more convenient it is for you to make plans or take business decisions based on your available funds. As we progress further into the digital age, it is expected that these kinds of payment options will become the norm and any commercial establishment which does not yet recognize the importance of fast payments will either have to change soon or perish down the line.