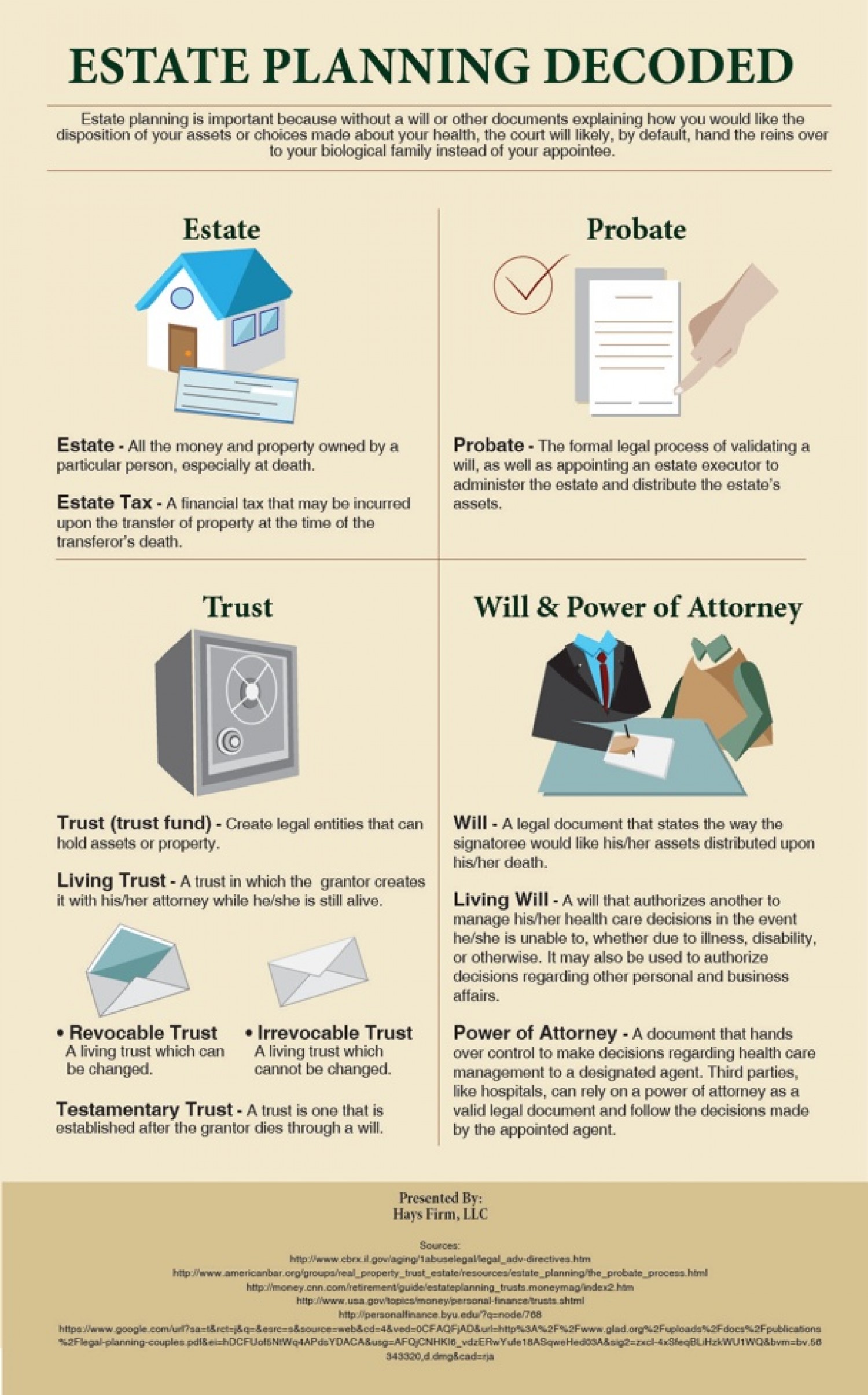

A good business owner should think of the continuity of their business long after they are gone. Leaving a business to your family or offspring is not enough. You must ensure that the death taxes will not run your business to the ground. Estate or death tax can take 35-50% of your business value months after your passing. In order to avoid this, business owners need to protect their businesses by taking on certain security options. Here are some of the reasons why estate planning is essential to business owners.

Handling Taxes

Death tax is hefty and it is usually collected within 9 months of your death. In order to keep your business afloat, you can invoke tax break section 303 which enables the current business owner to redeem stock worth 35% of the estate value. This helps avoid selling of the business in order to raise the money to clear the taxes.

You can also invoke section 6166 which allows the business owner to pay the taxes in 10 annual instalments starting from the 5th year after the death of the business owner. This is however implemented only if 35% of the gross income comes from profits of the business. This section allows the business to gain the money for taxes and keep the business in operation.

Buy-Sell Agreements

This is an agreement between the shareholders and it notes down the value of the shares and the business as a whole. In the event that the business owner passes away, the shareholders may decide to sell the business or buy the shares of the dead partner as part of the document’s instruction. The agreement can also include information about people the owner may wish to keep out of the business.

Life Insurance

Business partners can take up life insurance and name each other as beneficiaries. This will help them get capital to buy out the deceased partner without tapping into the business’ funds. By doing this, the business does not suffer any losses.

Heirs

With the passing of a loved one, family members face a lot of challenges, especially when it comes to dividing estates. It is therefore important to work with an estate planning lawyer and clearly stipulate in your will which family member you would like to take over when you are gone. Your decision will help keep your business running and avoid periods of stagnation while the family is busy battling over who should take over. A will also helps the family to avoid nasty confrontations, therefore preserving your image long after you are gone.

It is important for any business owner to think long-term when it comes to their business and have an estate plan in place. Work with an estate planning lawyer so they can advise you on the best course of action for the continuity of your business. It is also prudent to involve your family members and partners in any decision concerning the business so they can be on board with your ideas and be willing to carry on your legacy.

Learn more

Chances are, writing a will is actually a lot easier and not half as expensive as you think it would be. Moreover, wills aren’t only for the wealt ...

As you likely already know, running a business can be extremely difficult. One of the few things that is actually more difficult is managing your ...

Family-owned businesses are getting greater market exposure these days. With small firms growing to compete with the market biggies in the current ...

When we think about costs for running a small business we tend to think about the costs of paying wages to employees, shipping, maintaining the bu ...

Bankruptcy is a topic that probably fills any business owner, no matter the size of the business, with dread. However, if you’re a small business ...